fvzb.ru

Learn

Best Accounting Software For Amazon Fba Sellers

Integrate Amazon and your accounting software for accurate accounting A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries. But ultimately, the best accounting software for Amazon sellers is the one that meets your specific needs and helps you run your business more efficiently. Does. The Best Accounting Methods for Amazon Sellers · QuickBooks · A2X · SellerBoard · EcomBalance · SellAnalytix · ConnectBooks · Try SmartScout Now. There are just a few concepts to master in order to maintain your Amazon Seller accounting like a pro with QuickBooks. To make it as easy and accurate as. Sellerboard is the accurate profit analytics tool for Amazon FBA sellers. Track your sales and profits on Amazon FBA in real time. In addition, sellerboard. 3. Jungle Scout (All-in-One Management). Jungle Scout is another powerful software solution designed specifically for Amazon FBA sellers. Jungle Scout. FreshBooks gives you the tools needed to create invoices, manage expenses, and view reports that will give you the insight to grow your business as an Amazon. Since , I have been an Amazon Seller that uses either Google Sheets or Microsoft Excel spreadsheets to manage business bookkeeping. I have had to work with. 5 Best Accounting Software for Amazon Sellers · 1. QuickBooks Online · 2. Wave · 3. FreshBooks · 4. Xero · 5. Finaloop. Integrate Amazon and your accounting software for accurate accounting A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries. But ultimately, the best accounting software for Amazon sellers is the one that meets your specific needs and helps you run your business more efficiently. Does. The Best Accounting Methods for Amazon Sellers · QuickBooks · A2X · SellerBoard · EcomBalance · SellAnalytix · ConnectBooks · Try SmartScout Now. There are just a few concepts to master in order to maintain your Amazon Seller accounting like a pro with QuickBooks. To make it as easy and accurate as. Sellerboard is the accurate profit analytics tool for Amazon FBA sellers. Track your sales and profits on Amazon FBA in real time. In addition, sellerboard. 3. Jungle Scout (All-in-One Management). Jungle Scout is another powerful software solution designed specifically for Amazon FBA sellers. Jungle Scout. FreshBooks gives you the tools needed to create invoices, manage expenses, and view reports that will give you the insight to grow your business as an Amazon. Since , I have been an Amazon Seller that uses either Google Sheets or Microsoft Excel spreadsheets to manage business bookkeeping. I have had to work with. 5 Best Accounting Software for Amazon Sellers · 1. QuickBooks Online · 2. Wave · 3. FreshBooks · 4. Xero · 5. Finaloop.

QuickBooks is a small business accounting tool that is user-friendly and easy to use. If you want to track sales, expenses, and inventory, Quickbooks is one of. NerdWallets Best Accounting Software for Amazon FBA Sellers · As your business grows and scales up, your expenses should scale too. · During an audit, the proof. QuickBooks is a useful accounting software made for Amazon sellers, providing a stress-free solution for managing cash flow and sales tracking. With a range of. At GoForma, we are committed to empowering Amazon sellers with exceptional accountancy services. Our team of specialized Amazon Seller Accountants is well-. Accounting automation software for Amazon sellers on QuickBooks Online. Also automate order info & inventory management. Webgility has. Since , I have been an Amazon Seller that uses either Google Sheets or Microsoft Excel spreadsheets to manage business bookkeeping. I have had to work with. As an individual seller on Amazon, you likely started out using a basic bookkeeping software like Quickbooks or FreshBooks. One thing that you need to do once. This tool is fast, user-friendly, and is trusted by Amazon sellers and leading Amazon Accounting firms. · A2x is highly efficient and accurate accounting. Link My Books acts as a bridge between your Amazon seller account and any other accounting software. Ideally, this should be used with Xero, as it is optimized. ConnectBooks is your new Amazon accountant, offering the best Amazon accounting software to manage your finances effectively. Turn hours of manual data. Use Xero alongside your Amazon Seller Central account to track sales, manage the cash coming in and out, and view cash flow with a simple click. Analytics. An. Wave accounting is a great free accounting tool for anyone getting starting selling on Amazon. We recently released an integration for you to. Accrual accounting works well for fast-growing FBA businesses that have large surges in sales during the year. It would be best if you spoke to your Amazon. Many Amazon sellers use cloud-based software to handle these needs effectively. Some of the most popular cloud-based accounting software options are Quickbooks. Best accounting software for Amazon sellers · QuickBooks · A2X Accounting · Xero for Amazon Sellers · Fetcher for Amazon Sellers · Link My Books · Taxomate · Seller. QuickBooks is a popular choice among FBA sellers due to its comprehensive features and user-friendly interface. Its integration with Amazon Seller Central. At GoForma, we are committed to empowering Amazon sellers with exceptional accountancy services. Our team of specialized Amazon Seller Accountants is well-. 3. Jungle Scout (All-in-One Management). Jungle Scout is another powerful software solution designed specifically for Amazon FBA sellers. Jungle Scout. Best Amazon Seller Accounting Softwares · QuickBooks · Freshbooks · Xero · Sage Accounting · Wave. Sellers that want more robust reporting and functionality out of their accounting software would be happy with Xero or QuickBooks, with possible 3rd party add-.

What To Do Against Inflation

Our research has found that equities outperformed inflation 90% of the time when inflation was low (below 3% on average) and rising. I intend to make those hard choices. I have already vetoed bills that would undermine our fight against inflation, and the Congress has sustained those vetoes. Keeping your money in savings and share certificate accounts is a wise place to start in protecting yourself from inflation. Although some portfolios will employ inflation protection through investing in inflation-linked bonds, which also come with limitations, few portfolios. Budget and keep track of your spending. A budget can let you see your spending habits and help you find ways to save. · Make a financial roadmap. A financial. 3 Ways to Prepare for Inflation Long-Term · 1. Try to add more money to your emergency fund. · 2. Cut down any debt that comes with variable interest rates. · 3. The Federal Reserve seeks to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates. There are several assets that have been an hedge against inflation, but over long periods of time. Some examples include: Gold, stocks, commodies, real estate. The Inflation Reduction Act's investments are already making positive impacts on the lives of everyday Americans by creating good-paying jobs, strengthening our. Our research has found that equities outperformed inflation 90% of the time when inflation was low (below 3% on average) and rising. I intend to make those hard choices. I have already vetoed bills that would undermine our fight against inflation, and the Congress has sustained those vetoes. Keeping your money in savings and share certificate accounts is a wise place to start in protecting yourself from inflation. Although some portfolios will employ inflation protection through investing in inflation-linked bonds, which also come with limitations, few portfolios. Budget and keep track of your spending. A budget can let you see your spending habits and help you find ways to save. · Make a financial roadmap. A financial. 3 Ways to Prepare for Inflation Long-Term · 1. Try to add more money to your emergency fund. · 2. Cut down any debt that comes with variable interest rates. · 3. The Federal Reserve seeks to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates. There are several assets that have been an hedge against inflation, but over long periods of time. Some examples include: Gold, stocks, commodies, real estate. The Inflation Reduction Act's investments are already making positive impacts on the lives of everyday Americans by creating good-paying jobs, strengthening our.

Common anti-inflation assets include gold, commodities, various real estate investments, and TIPS.

Inflation hedge is an investment that is made for the purpose of protecting the investor against decreased purchasing power of money due to the rising prices. commodities are also self-explanatory. as inflation rise, commodity prices rise with it. so if you invest in the right commodity, you can beat. Investing can be another way to beat rising prices, if the returns you make on the stock market, for example, are higher than the rate of inflation. The simple. Increasing the rate of return on your savings through investing is the best way to counter the effects of inflation, and it will help ensure that the money you. The primary method of controlling inflation is contractionary monetary policy, mainly through forcing borrowing costs higher. Helping the Community Deal with Inflation · Circulate deals. · Create affiliate agreements. · Publicize grants · Host seminars on economics. · Share small business. For many investors, inflation-protected bonds – specifically designed to hedge against rising consumer prices – may be an effective way to seek to mitigate. Inflationary periods suddenly make U.S. savings bonds interesting investments. Even though you can only purchase $10, annually and they're considered non-. Review your portfolio and make sure you include allocations to assets that have traditionally served as a hedge against inflation, such as real estate, Treasury. SUMMARY: THE INFLATION REDUCTION ACT OF The Inflation Reduction Act of will make a historic down payment on deficit reduction to fight inflation. And in the shadow of debt and slow economic growth, central banks cannot control inflation on their own. John H. Cochrane is a senior fellow of the Hoover. New Dems Make Progress on our Action Plan to Fight Inflation · Passing the Inflation Reduction Act, legislation that reflects New Dem priorities and is key plank. 2> Stocks: Historically, stocks have provided a good hedge against inflation. Companies can often raise prices during inflationary periods. commodities are also self-explanatory. as inflation rise, commodity prices rise with it. so if you invest in the right commodity, you can beat. Make sure that any cash savings you have, are getting the highest interest rate possible. These days you can switch savings accounts and ISAs relatively easily. History suggests that investing in assets such as shares has been a reliable way to grow your savings faster than inflation over the long term. However, over. One excellent inflation investment strategy that you can take advantage of in is to invest in I Bonds. These U.S. savings bonds earn interest based on a. There are no silver bullets—you may need a combination of investments to provide a potential return that can keep up with the effects of rising prices. And some. Right now, high inflation isn't necessarily a U.S.-only phenomenon. But, during times when it is, the U.S. dollar can get weaker. In these situations, investing.

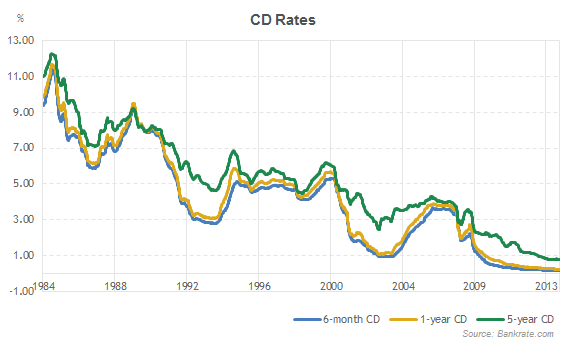

Interest Rate On 1 Million Dollar Cd

Well, the average rate on a jumbo month CD was % APY in —but you can earn interest rates as high as 5% (depending on the bank and your CD term). Keep in mind that the APY on savings accounts can fluctuate without warning, so if you want to lock in a high interest rate for an extended time, you may want. View the current rates for provincial bonds, corporate bonds, U.S. dollar pay bonds and more. CD Rates Over $1 Million Learn More ; 6 Months, % ; 12 Months, % ; 18 Months, % ; 24 Months, %. Thus, we get an effective interest rate of %, since the compounding makes the CD paying % compounded monthly really pay % interest over the course. CDARS® CDs · 1 year, $12M % · 2 year, $1M % · 3 year. FDIC-Insured Certificates of Deposit Rates ; 1-year, % ; month, % ; 2-year, % ; month, N/A. With a bond paying a 2% interest rate, a $1 million investment could earn you $20, per bond pay interest income annually. High-interest savings accounts. The Bankrate promise ; CDs that pay competitive rates, %, $5, ; CDs that pay the national average, %, $1, ; CDs from big brick-and-mortar banks, Well, the average rate on a jumbo month CD was % APY in —but you can earn interest rates as high as 5% (depending on the bank and your CD term). Keep in mind that the APY on savings accounts can fluctuate without warning, so if you want to lock in a high interest rate for an extended time, you may want. View the current rates for provincial bonds, corporate bonds, U.S. dollar pay bonds and more. CD Rates Over $1 Million Learn More ; 6 Months, % ; 12 Months, % ; 18 Months, % ; 24 Months, %. Thus, we get an effective interest rate of %, since the compounding makes the CD paying % compounded monthly really pay % interest over the course. CDARS® CDs · 1 year, $12M % · 2 year, $1M % · 3 year. FDIC-Insured Certificates of Deposit Rates ; 1-year, % ; month, % ; 2-year, % ; month, N/A. With a bond paying a 2% interest rate, a $1 million investment could earn you $20, per bond pay interest income annually. High-interest savings accounts. The Bankrate promise ; CDs that pay competitive rates, %, $5, ; CDs that pay the national average, %, $1, ; CDs from big brick-and-mortar banks,

Typically, savings accounts and money market accounts offer lower interest rates than certificates of deposit (CDs) or other investment vehicles. Simply choose the length of time (term) and interest rate you want to Lastly learn how to earn that million dollar savings with our Save a Million. Relationship rates available. Earn a Relationship Interest Rate 1 when you link your Platinum Savings account to an eligible checking account. Flexible access. Minimum deposit of $2, required to open and earn stated APY. Interest on CDs longer than 12 months must be paid out at least annually. The annual percentage. The highest 1-month CD rate today is % from Merchants Bank of Indiana. interest for a one-year CD. Read review. Why we picked it. EverBank stands out. Keep your large deposits safe with access to FDIC protection on multi-million dollar CD investments. Lock in your interest rate for one month up to five years. Using CDARS®, you can access multi-million dollar FDIC Insurance on your CD Deposits. You sign one agreement with North Central Bank and earn one interest rate. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. After 10 years, you will have earned $6, in interest for a total balance of $16, But remember, this is just an example. Savings account APYs are. National deposit rates for a 3, 6 and month CD are %, % and %, respectively, according to FDIC's Monthly National Rates and Rate Caps-Monthly. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. Line graph compares returns earned on $1 million in varies accounts based on typical rates. Here's a comparison of how much a million dollars in a single. In , however, only % of households had a CD. The reason? CDs used to be a much better deal. At the beginning of , for instance, a one-year. It depends on the interest rate and type of account you chose. If you chose a CD, you would get a higher rate of interest, but you couldn't. Today's Interest Rates. Shop and compare current interest rates to grow your savings. Savings Account Rates · CD Rates · Money Market Rates · Fixed Annuity. Monthly Rate Cap Information as of August 19, ; Savings, , ; Interest Checking, , ; Money Market, , ; 1 month CD, , Earn % APY on our 3-Month CD! Open Account. Turn Time Into Money. Are you ready to earn more with your cash? Choose your term and see bigger returns. After 4 years earning % compounded monthly, your CD is worth $31,! Year. 1 Interest rate The published interest rate for this CD. Make sure to enter. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Why let the money sit in a savings with a lower interest rate Earn Interest And Access Multi-Million-Dollar FDIC Insurance With IntraFi® Network Deposits.

Prmtx Mutual Fund

The Fund seeks to provide long-term capital appreciation by investing primarily in common stocks of companies operating in the media, telecommunications, and. Mutual Fund Profile. Breaking News. T Rowe Price Communications & Technology Fund. Telecommunications. PRMTX. Price. Last Close, $ + 0 %. Week. The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in securities of communications and technology. Similar to PRMTX · Fund Type. Mutual Fund ; Trading · Last Close. $ ; Dividends · Dividend Yield (TTM). % ; Performance · 1 Month Price Performance. %. The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in securities of communications and technology. It is a "basket" of securities that index the Communications investment strategy and is an alternative to a Communications mutual fund. Fees are very low. The investment seeks to provide long-term capital growth. The fund will normally invest at least 80% of its net assets (including any borrowings for. T. Rowe Price Communications & Technology Fund, Inc.: (MF: PRMTX). (NASDAQ Mutual Funds) As of Aug 5, PM ET. Add. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. T. Rowe Price Communications & Technology Fund Investor Class PRMTX. Schwab Mutual Fund. The Fund seeks to provide long-term capital appreciation by investing primarily in common stocks of companies operating in the media, telecommunications, and. Mutual Fund Profile. Breaking News. T Rowe Price Communications & Technology Fund. Telecommunications. PRMTX. Price. Last Close, $ + 0 %. Week. The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in securities of communications and technology. Similar to PRMTX · Fund Type. Mutual Fund ; Trading · Last Close. $ ; Dividends · Dividend Yield (TTM). % ; Performance · 1 Month Price Performance. %. The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in securities of communications and technology. It is a "basket" of securities that index the Communications investment strategy and is an alternative to a Communications mutual fund. Fees are very low. The investment seeks to provide long-term capital growth. The fund will normally invest at least 80% of its net assets (including any borrowings for. T. Rowe Price Communications & Technology Fund, Inc.: (MF: PRMTX). (NASDAQ Mutual Funds) As of Aug 5, PM ET. Add. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. T. Rowe Price Communications & Technology Fund Investor Class PRMTX. Schwab Mutual Fund.

T Rowe Price Communications & Technology Fund mutual fund holdings by MarketWatch. View PRMTX holdings data and information to see the mutual fund assets. Only daily data (3M Chart and above) is available for Mutual Funds. Price Performance. See More. Period, Period Low. T. Rowe Price Communications & Technology Fund. Shareclass. T. Rowe Price Comm & Tech Investor (PRMTX). Type. Open-end mutual fund. Investment Objective & Strategy. The fund seeks to provide long-term capital growth. The fund will invest at least 80% of net assets in the common stocks of. Analyze the Fund T. Rowe Price Communications & Technology Fund Investor Class having Symbol PRMTX for type mutual-funds and perform research on other. T Rowe Price is at this time traded for The entity has historical hype elasticity of , and average elasticity to hype of competition of PRMTX. T. Rowe Price Comm & Tech Investor (PRMTX) mutual fund forecast & analyst price target predictions based on 25 analysts offering months price targets for. Find the latest performance data chart, historical data and news for T. Rowe Price Communications & Technology Fund, Inc. (PRMTX) at fvzb.ru I recently discovered the PRMTX mutual fund, which revolves around T Rowe price communications tech. I typically stick to ETFs. See performance data and interactive charts for T. Rowe Price Communications & Tech Fd (PRMTX) These Fidelity mutual funds are excellent portfolio building. Rowe Price Media and Telecommunications Fund PRMTX. Growth of a Trades in no-load mutual funds available through Schwab's Mutual Fund OneSource®. Investment Policy. The Fund seeks to provide long-term capital growth. It invests primarily in common stocks of companies operating in the media. PRMTX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. (PRMTX) is an actively managed Sector Equity Communications fund. T. Rowe Price launched the fund in The investment seeks to provide long-term capital. MUTUAL FUND SNAPSHOT The Easy Way To Find Great Mutual Funds! -- Choose --, All Mutual Funds. Complete T Rowe Price Communications & Technology Fund funds overview by Barron's. View the PRMTX funds market news. Mutual Funds & ETFs: All of the mutual. Get PRMTX mutual fund information for T.-Rowe-Price-Communications-&-Technology-Fund-Investor-Class, including a fund overview,, Morningstar summary. Get the latest T. Rowe Price Communications & Technology Fund Inc. (PRMTX) MUTUAL FUNDS. May 4, AM EDT. First Quarter Ultra Fund Families. Some. T. Rowe Price Communications & Technology Fund Investor Class PRMTX. Schwab Mutual Fund OneSource Select List®. NAV, Change. Rowe Price Communications & Technology Fund, Inc.: (MF: PRMTX). (NASDAQ Mutual Funds) As of Aug 21, PM ET. Add to portfolio. $

Maximum Cd Deposit

:max_bytes(150000):strip_icc()/cd-basics-how-cds-work-315245-v4-5ba5068946e0fb002558ccde.png)

Yes, CD investments up to $, are safe if they are held with a bank insured by FDIC or a credit union insured by NCUA. In today's high interest rate. Maximum deposit is $10,, The CD will automatically renew for a month term from the initial and each succeeding maturity date at the interest rate then. $1, minimum opening deposit up to a maximum of $, Return to content, Footnote 2. Footnote 3. Online application is not valid for single maturity CDs. new Featured CD. We may limit the amount you deposit in one or more Featured CDs to a total of $1,, ($, for CDs opened through fvzb.ru). What you get with a CD · Competitive, fixed rates of return · Flexible terms · FDIC-insured up to the maximum permitted by law · Relationship rates for customers. The minimum deposit to open an account is $50, and the maximum is $, image. Don't miss out on potential gains with market changes. image. That means if the bank goes under, you won't lose your savings (of up to $,). The $, FDIC insurance limit is per bank, per depositor and per account. FDIC-insured up to the established limit. Get Started. Focused bearded ICS® (IntraFi Cash Service SM) and CDARS® (Certificate of Deposit Account. The minimum deposit required to open an account is $2, and the maximum amount is $, per account. Penalties may apply to early withdrawals. Fees may. Yes, CD investments up to $, are safe if they are held with a bank insured by FDIC or a credit union insured by NCUA. In today's high interest rate. Maximum deposit is $10,, The CD will automatically renew for a month term from the initial and each succeeding maturity date at the interest rate then. $1, minimum opening deposit up to a maximum of $, Return to content, Footnote 2. Footnote 3. Online application is not valid for single maturity CDs. new Featured CD. We may limit the amount you deposit in one or more Featured CDs to a total of $1,, ($, for CDs opened through fvzb.ru). What you get with a CD · Competitive, fixed rates of return · Flexible terms · FDIC-insured up to the maximum permitted by law · Relationship rates for customers. The minimum deposit to open an account is $50, and the maximum is $, image. Don't miss out on potential gains with market changes. image. That means if the bank goes under, you won't lose your savings (of up to $,). The $, FDIC insurance limit is per bank, per depositor and per account. FDIC-insured up to the established limit. Get Started. Focused bearded ICS® (IntraFi Cash Service SM) and CDARS® (Certificate of Deposit Account. The minimum deposit required to open an account is $2, and the maximum amount is $, per account. Penalties may apply to early withdrawals. Fees may.

CD minimum opening deposit of $1, is required. Maximum opening deposit per CD is $, Early withdrawal penalty may apply if you withdraw any. CDs are FDIC-insured up to $, and come with no market risk. Flexible Terms. Terms between 3 to 60 months. Fixed Rates. Guaranteed fixed rate for the. Answer: CDs are a type of savings account that offer maximum security of principal—FDIC insured up to applicable limits—and a guaranteed rate of return. They. Track progress with Online and Mobile banking; MAX Jumbo Share Certificate Accounts are also available - $, minimum deposit; Note: You may lose a. The Bank may limit the amount you may deposit in this product to an aggregate of $ million. 2. A Relationship Interest Rate is variable and subject to change. Federal law sets a minimum penalty on early withdrawals from CDs, but there is no maximum penalty. If you withdraw money within the first six days after deposit. Deposit products and services are offered by Popular Bank. Popular Bank is a Member FDIC institution. Your deposits are insured, in aggregate, up to $, It has 5-month celebration certificate paying % APY, but this CD special only allows a $3, maximum opening deposit and requires you to have another bank. Most CDs require a $ minimum deposit and are available as both personal and business accounts. You choose a term ranging from three months to six years. Certificate of Deposit · 1 to 3 years term CDs · Fixed interest rates on a variety terms · $1, minimum balance to open · FDIC insurance up to the maximum limit. CDs are a set-it-and-forget-it kind of investment. You deposit funds for a set length of time, earning more interest than a savings account, and with no. FDIC Deposit Insurance. Deposit balances are insured up to the maximum amount permitted by law. The standard insurance amount is $, per depositor, for. max on your deposit, check our ranking of the best CD rates. Our ranking of the best jumbo CD rates can help you maximize your earnings on big deposits. The average decreased basis points in January and basis points in February for a total decline of basis points. The average fell from its peak of. Funds deposited at an FDIC-insured institution are insured, in aggregate, up to $, per depositor, per insured institution based upon account type by the. Bank Certificates of Deposit (CDs) are savings accounts with a fixed interest rate and term. When you deposit money in a bank for a specified period, the bank. Certificate of Deposit (CD). UP TO. %. APY*. No minimum balance. Lock The maximum APY shown for CDs is for a 9-month CD. See all non-IRA CD rates. CERTIFICATE OF DEPOSIT (CD). Put your money to work with this longer term You'll get FDIC protection up to the full legal limit. Choose the. CDs are FDIC-insured up to the maximum allowed by law. %. APY2. 3-month Fixed Rate Certificate of Deposit (CD) accounts earn a fixed interest. Count on guaranteed returns to reach your savings goals. Get Started. Your deposits are FDIC-insured up to the maximum amount allowed by law.

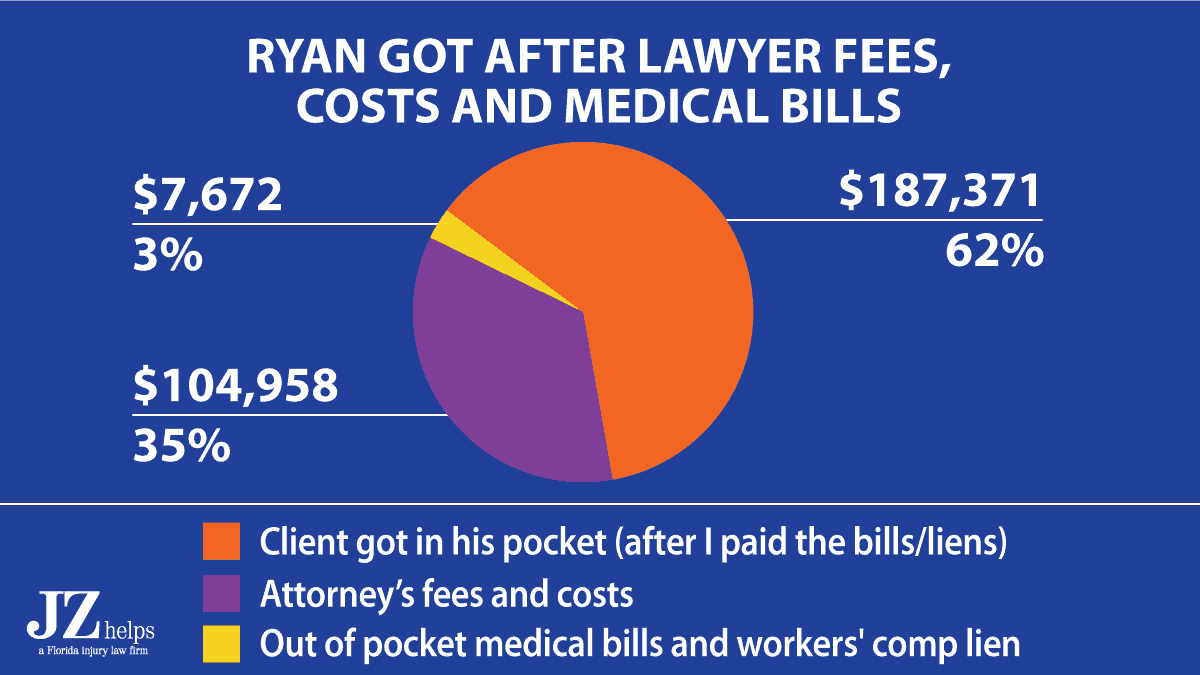

Average Car Crash Settlement

If there is genuinely no injury, your settlement will likely be zero. If you have some injury but no medical treatment, you are looking at a typical settlement. I Car Accidents in Tennessee. The typical settlement amount following an automobile accident is $41, Due to the data's higher proportion of. The average settlement amount for back and neck injuries from car crash can range from $10, for minor injuries like whiplash to several hundred thousand. On average, the amount of money you might receive for a car accident settlement in Virginia is typically between $20, and $30,, contingent upon the extent. What is the Average Car Accident Settlement in California. In California, the average car settlement amount is $21, Under California law, accident victims. Car accident settlements in Pennsylvania range from five figures to eight figures, depending on the severity of injuries and comparative negligence. A settlement payout could be as low as a few hundred dollars to as high as hundreds of thousands or more. Typical Car Accident Settlement Amounts · $ Million Car Accident Settlement for a Nassau County woman with a history of prior injuries · Multi-Million Dollar. A settlement payout could be as low as a few hundred dollars to as high as hundreds of thousands or more. If there is genuinely no injury, your settlement will likely be zero. If you have some injury but no medical treatment, you are looking at a typical settlement. I Car Accidents in Tennessee. The typical settlement amount following an automobile accident is $41, Due to the data's higher proportion of. The average settlement amount for back and neck injuries from car crash can range from $10, for minor injuries like whiplash to several hundred thousand. On average, the amount of money you might receive for a car accident settlement in Virginia is typically between $20, and $30,, contingent upon the extent. What is the Average Car Accident Settlement in California. In California, the average car settlement amount is $21, Under California law, accident victims. Car accident settlements in Pennsylvania range from five figures to eight figures, depending on the severity of injuries and comparative negligence. A settlement payout could be as low as a few hundred dollars to as high as hundreds of thousands or more. Typical Car Accident Settlement Amounts · $ Million Car Accident Settlement for a Nassau County woman with a history of prior injuries · Multi-Million Dollar. A settlement payout could be as low as a few hundred dollars to as high as hundreds of thousands or more.

There is no average settlement for a car accident because every case is different. A lawyer can help you fight for what's fair. Free consultations. The average settlement for car accident back and neck injury is approximately $ based on over cases. You may have heard about huge car accident settlements from news outlets and the media. According to the car accident settlement examples listed on this page. Car accident settlement amounts in Arizona can vary enormously, but the rough average falls between roughly $ and goes up to over $ A typical car accident settlement may be anywhere between $5,$30, However, Georgia's at-fault laws and the circumstances of your accident will affect. Average Settlement Amounts for a Car Accident. Auto accident claim data shows that on average, victims can expect a successful car accident settlement to total. According to the insurance industry's data, the average settlement for a car accident that causes a nonfatal injury is about $20, However, that's an. Typical Car Accident Settlement Amounts: No Injury. When no one is injured, the only money you are likely to get is for damage to your vehicle. According to the. According to the Insurance Information Institute, the average personal injury car accident claim in settled for $18, The average property damage car. For example, if your doctors think it will take you six months to completely recover, your car accident lawyer might request $ per day. Multiplying that by. The average car settlement in Kentucky can vary greatly, depending on the factors involved. These include the severity of the accident, the seriousness of. While the average car accident injury settlement is usually between $15, and $25,, it can be a lot more or less depending on the circumstances of the. Injured car accident victims often wonder about the average settlement amount in Virginia. A lawyer explains how compensation is calculated. Learn the average settlement amounts for auto injury lawsuits in New York City, how these are calculated, and how to maximize compensation. Typical car accident settlement amounts are around $15, for cases involving accident injuries and $3, for cases involving property damage. While some car. This means that if a jury or settlement determines the full value of damages is $,, the claimant who was 20% at fault can only recover 80% of that amount. For car accidents resulting in traumatic brain injuries, spinal damage, or long-lasting injuries, the medical expenses and pain and suffering damages will be. The truth is that every car crash case is unique, and the amount of compensation is contingent on the severity and type of injuries suffered. According to studies, the average personal injury settlement (not including property damage) for car accident claims is a little under $20,

Boa Picture Check Deposit

Just scan paper checks from your place of business and send the images securely over the internet to Bank of America for deposit. What are the benefits of using. Mobile Check Deposit ; Eastern or Central, Funds deposited before p.m. ET on a business day will generally be available the next business day. ; Mountain or. There is a monthly limit for Mobile Check Deposits and it's displayed when you select your deposit account. Deposit a check from anywhere in the US and US territories with Mobile Deposit. Follow these steps on our mobile app to snap a picture of your check. How does online check deposit work? · Sign into your selected banking mobile app · Tap "Deposit checks" and choose the account where you want your deposit to go. With Mobile Deposits, you can deposit personal and business checks safely and securely with your mobile device—all without having to visit a branch or ATM. Easily deposit checks 1 into your Bank of America and Merrill investment accounts 2 and receive an immediate confirmation that the check is processing. 1. Download your bank's app · 2. Endorse the check · 3. Open the bank app on your mobile device and select the mobile deposit function · 4. Choose the account. No. You must have the physical check in your possession to use mobile deposit. Just scan paper checks from your place of business and send the images securely over the internet to Bank of America for deposit. What are the benefits of using. Mobile Check Deposit ; Eastern or Central, Funds deposited before p.m. ET on a business day will generally be available the next business day. ; Mountain or. There is a monthly limit for Mobile Check Deposits and it's displayed when you select your deposit account. Deposit a check from anywhere in the US and US territories with Mobile Deposit. Follow these steps on our mobile app to snap a picture of your check. How does online check deposit work? · Sign into your selected banking mobile app · Tap "Deposit checks" and choose the account where you want your deposit to go. With Mobile Deposits, you can deposit personal and business checks safely and securely with your mobile device—all without having to visit a branch or ATM. Easily deposit checks 1 into your Bank of America and Merrill investment accounts 2 and receive an immediate confirmation that the check is processing. 1. Download your bank's app · 2. Endorse the check · 3. Open the bank app on your mobile device and select the mobile deposit function · 4. Choose the account. No. You must have the physical check in your possession to use mobile deposit.

Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review. Take a picture of the front of the check. Then flip it over, make sure you've signed the back, and take a picture. Enter the amount you're depositing. Add a. Can I do a Mobile Check Deposit from a desktop or laptop computer? · Step 1: Endorse Your Checks · Step 2: Select Your Scanner · Step 3: Enter the Total Deposit. Endorse the back of your check, and write “For Square mobile deposit only” below your signature. Take a picture of the front and back of the check using a dark. Go to the machine, · Choose the on-screen option for · Choose the account you want to deposit to · Enter the amount of your deposit if necessary. From the bottom of the dashboard select Deposit a check then View mobile deposits. From there you can select the Completed or Pending tabs to view your mobile. Mine works fine. Keep in mind that some checks now require you to put a check mark in a box or write "for digital deposit only" on the back. Depositing a check remotely lets you put money into a checking or savings account just by using your smartphone or tablet to snap a picture of the check you. Deposit checks and get immediate confirmation with our Mobile Banking app; Securely send money to friends and family using Zelle®. Get the app. Send and receive. Remote Deposit Online allows your business to make deposits remotely using a bank scanner. Just scan paper checks from your place of business and send the. If you make less than 20 check deposits per month, you may also be interested in our Mobile Check Deposit service. After an initial day. Scan the front of the check, using the phone's camera. Make sure to provide plenty light. A blurry picture at this point will require you to rescan the check. Depositing a check remotely lets you put money into a checking or savings account just by using your smartphone or tablet to snap a picture of the check you. You must be enrolled in both Online and Mobile Banking before you can use Mobile Deposit. Please give us a call at or visit one of our branch. Use the camera on your mobile device to deposit paper checks quickly and easily into your Merrill accounts instead of mailing a check or going to a branch or. With Mobile Deposits, you can deposit personal and business checks safely and securely with your mobile device—all without having to visit a branch or ATM. No longer do you need to drive to the bank to deposit your checks. These days, most financial institutions have corresponding apps that allow you the ability to. Mobile deposit: The deposit confirmation screen on your device will tell you of any hold. Email alert: If a hold was not originally placed when you deposited. From the bottom of the dashboard select Deposit a check then View mobile deposits. From there you can select the Completed or Pending tabs to view your mobile.

How To Keep Up With Inflation

We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. For example, consumers need to keep track of the prices of items they purchase. When inflation is high, they need to spend more time shopping, looking for. One of the most widely accepted ways to maintain value is to have a widely diversified portfolio where commodities, bonds, and inflation-protected investments. You'll set a percentage of income you can withdraw each month. · Each year your sustainable spending rate will increase slightly to keep the pace with rising. inflation were higher, as long as the borrower's income keeps up with inflation. Policymakers announce their intention to keep economic activity low. Investments with the potential to keep up with inflation—or exceed it—over time typically come with some risks. Historically, stocks have offered the highest. Changing your shopping habits to reduce your expenses – making due with less, buying in advance of rising prices, and switching to generic brands – can help. protect your organization, first familiarize yourself with the concept of inflation This also results in supply not being able to keep up with consumer demand. 1. Consider adding some inflation-resistant diversifiers · 2. Take a close look at your budget · 3. Don't get too comfortable in cash · 4. Reassess your emergency. We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. For example, consumers need to keep track of the prices of items they purchase. When inflation is high, they need to spend more time shopping, looking for. One of the most widely accepted ways to maintain value is to have a widely diversified portfolio where commodities, bonds, and inflation-protected investments. You'll set a percentage of income you can withdraw each month. · Each year your sustainable spending rate will increase slightly to keep the pace with rising. inflation were higher, as long as the borrower's income keeps up with inflation. Policymakers announce their intention to keep economic activity low. Investments with the potential to keep up with inflation—or exceed it—over time typically come with some risks. Historically, stocks have offered the highest. Changing your shopping habits to reduce your expenses – making due with less, buying in advance of rising prices, and switching to generic brands – can help. protect your organization, first familiarize yourself with the concept of inflation This also results in supply not being able to keep up with consumer demand. 1. Consider adding some inflation-resistant diversifiers · 2. Take a close look at your budget · 3. Don't get too comfortable in cash · 4. Reassess your emergency.

inflation, so don't feel alone if your budget is struggling to keep up. While the annual inflation rate appears to be headed in the right direction, it. How to protect against inflation Some savings accounts are index-linked which means they'll pay interest that tracks inflation but won't always keep up with. If these businesses are unable to keep up with the increased consumer demand, their remaining stock becomes more valuable, and prices may rise. This kind of. keep up with inflation. Second, portfolios need to not just position for recurring transitions between recessionary and non-inflationary growth environments. Keeping your money in savings and share certificate accounts is a wise place to start in protecting yourself from inflation. 2. Track your spending. When costs. Discount retailer Dollar Bill's has been struggling to maintain its margins over the past two years because of inflationary pressures, delays on imported. That's not to say that paying off debt isn't important, and achieving debt freedom can help free up money in your budget, which also increases your purchasing. Conventional wisdom is that stocks are a reasonable hedge against inflation. Input prices go up, wages go up, so companies raise their selling prices to keep. “The best way to beat inflation is to make sure your savings and investments outpace inflation or at least keep up,” Shon Anderson, CFP and president at. Real estate income may also help buffer against inflation, as landlords can increase their rent to keep pace with the rise of prices overall. The U.S. There are no silver bullets—you may need a combination of investments to provide a potential return that can keep up with the effects of rising prices. And some. 1. Inflation-proof your savings · 2. Make inflation-proof investments · 3. Speak to a mortgage broker · 4. Earn cashback · 5. Sign up to rewards schemes · 6. An inflation rate four times higher is wreaking havoc on workers' budgets, as pay increases fail to keep pace with rising prices. Real (inflation-adjusted). Investing in stocks, bonds, and Treasury bills is the best way to protect oneself from the effects of inflation in the long-term. The best strategy, regardless. 1. Monitor your budget. · 2. Identify which categories (food, gas, clothes, entertainment) have gone up the most and consider how you can lower them. · 3. Treasury Inflation-Protected Securities (TIPS) are U.S. Treasury bonds designed to keep up with the rate of inflation. The obvious solution is to ask for a pay raise of % or so to at least stay even with inflation, but that's not always the best strategy, experts say. Invest and stay invested. Investing can be a way to get out ahead of inflation and potentially receive a better rate of return on your money. Traditional. The Federal Reserve seeks to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates.

Ui Design Lessons

→ I would like to recommend Rachel How on YT to jumpstart your journey on UI/UX. → Google and CalArts offer UX Design courses on Coursera. This article is about the best free UX/UI design courses. It will present valuable resources that help you learn UI/UX design, such as tutorials and blogs. Learn how to design user interfaces from top-rated Udemy instructors. Whether you're interested in designing UI for apps, learning typography, or becoming a. This graphic and web design training course covers references, user experience (UX), and usability principles. Over 36 hours of video lessons, filled with strategies and live examples covering all major areas of UI design. Product Design (UX/UI) Course. Everything you need to know to become a product (UX/UI) designer, tailored to you, with a mindful approach. Learn the theory. Browse Designlab's catalog of fully-online UX, UI, and product design courses and programs – including our flagship career accelerator UX Academy and more. 4 tips on how to emphasize parts of the text - Sketch/Figma Tutorial - Free UI Design Course. Malewicz · · Glassmorphism Chat Bubble illustration. During this short course, you'll use the fundamental pillars of UI design (wireframing, symbols and buttons, color, typography, and hierarchy) to create your. → I would like to recommend Rachel How on YT to jumpstart your journey on UI/UX. → Google and CalArts offer UX Design courses on Coursera. This article is about the best free UX/UI design courses. It will present valuable resources that help you learn UI/UX design, such as tutorials and blogs. Learn how to design user interfaces from top-rated Udemy instructors. Whether you're interested in designing UI for apps, learning typography, or becoming a. This graphic and web design training course covers references, user experience (UX), and usability principles. Over 36 hours of video lessons, filled with strategies and live examples covering all major areas of UI design. Product Design (UX/UI) Course. Everything you need to know to become a product (UX/UI) designer, tailored to you, with a mindful approach. Learn the theory. Browse Designlab's catalog of fully-online UX, UI, and product design courses and programs – including our flagship career accelerator UX Academy and more. 4 tips on how to emphasize parts of the text - Sketch/Figma Tutorial - Free UI Design Course. Malewicz · · Glassmorphism Chat Bubble illustration. During this short course, you'll use the fundamental pillars of UI design (wireframing, symbols and buttons, color, typography, and hierarchy) to create your.

Is This Course Right for You? This course covers mobile UI design and is suitable for anyone who has a basic knowledge of UX design, such as intermediate. Master the end-to-end UX/UI design process with a real-world project. Michael Wong Instructor + Intermediate. Improve your design skills through interactive, hands-on professional courses. Discover Beginner Intermediate Advanced. Try our on-demand Master Classes instead! In just 60 minutes, you can learn directly from design experts about a variety of topics! I took fvzb.ru a few years back and I can highly recommend it. Worth the $$ and led to a job in the field. In this course, we'll cover the theory and methodologies behind UI and UX design. You'll also design your own wireframes and interactive prototypes. Learn UX design and get industry-recognized course certificates. Free + Paid Uxcel Learn UX design with guided, bite-sized education that's effective and fun. Learn how to design beautiful UIs in Figma with our interactive course platform. 16 hours of video instruction, 38 tests, 22 challenges. Learn the principles, techniques and craft of designing high-quality user interfaces through our UI design course. Online platforms now offer a plethora of UI design courses taught by influencers, seasoned designers, or even college instructors. Through BrainStation's live UI Design course, you'll learn user interface design principles and industry tools to create beautiful interfaces that resonate. In this course, you will gain an understanding of the critical importance of user interface design. You will also learn industry-standard methods. Used by Shift Nudge is the systematic process to learn the visual skills of interface design, even if you don't have a design background. Perfect for those. CourseCareers' UI/UX course teaches you how to get a job in UI/UX with no experience or degree required making $70k+. Our students finish learning in as. Uxcel is a comprehensive and user-friendly resource for learning UI/UX design. It excels in breaking down complex topics and providing clear and robust. In summary, here are 10 of our most popular ui courses ; UI / UX Design · California Institute of the Arts ; Principles of UX/UI Design · Meta ; Build Dynamic User. UX/UI Design training from Careerist: become a UX Designer with live classes and built-in internship. Get job application support and mentorship. Free UI/UX Course. Great Learning is offering a free course in UI UX Design to help individuals explore the world of User Interface and User Experience designs. Our industry-leading online programs connect you with experienced designers – to unlock learning and help you launch and grow a career in digital design. See what you'll be learning and understand why UI design is such an important part of the process. Welcome! Needs for the Course; Approach to the course; UI vs.

Are You Penalized For Withdrawing From A Roth Ira

Penalty when withdrawing contributions from a Roth IRA · Annual Contributions- Can be withdrawn anytime tax and penalty-free for any reason. Generally, Roth IRA withdrawals are not taxable for federal income tax withdrawal penalty. withdrawal penalty. IRA Comparison Reference. Traditional. If you withdraw earnings early from a Roth IRA, you may owe income tax and a 10% penalty. Some early withdrawals are tax-free and penalty-free. You can withdraw up to your total contribution amount at any time, without fear of taxes or penalties. For example, if you have contributed $50, to your Roth. However, if you convert a traditional IRA to a Roth IRA and then take any distribution during a five-year period after the conversion, the entire distribution. There is no administrative fee or penalty for withdrawing the money you put into your Roth IRA. You already paid taxes on your contributions, and you can have. Several IRS exceptions let you withdraw money from your Roth IRA without paying a penalty. A primary exception is for first-time homebuyers. You may still. Ages younger than 59 ½ with a Roth IRA you've had more than five years, you can avoid the penalty for early withdrawal and taxes on earnings if you: · Withdraw. While you must be 59½ to withdraw funds from a traditional IRA without penalty, there are some exceptions to that rule in certain qualifying circumstances. Keep. Penalty when withdrawing contributions from a Roth IRA · Annual Contributions- Can be withdrawn anytime tax and penalty-free for any reason. Generally, Roth IRA withdrawals are not taxable for federal income tax withdrawal penalty. withdrawal penalty. IRA Comparison Reference. Traditional. If you withdraw earnings early from a Roth IRA, you may owe income tax and a 10% penalty. Some early withdrawals are tax-free and penalty-free. You can withdraw up to your total contribution amount at any time, without fear of taxes or penalties. For example, if you have contributed $50, to your Roth. However, if you convert a traditional IRA to a Roth IRA and then take any distribution during a five-year period after the conversion, the entire distribution. There is no administrative fee or penalty for withdrawing the money you put into your Roth IRA. You already paid taxes on your contributions, and you can have. Several IRS exceptions let you withdraw money from your Roth IRA without paying a penalty. A primary exception is for first-time homebuyers. You may still. Ages younger than 59 ½ with a Roth IRA you've had more than five years, you can avoid the penalty for early withdrawal and taxes on earnings if you: · Withdraw. While you must be 59½ to withdraw funds from a traditional IRA without penalty, there are some exceptions to that rule in certain qualifying circumstances. Keep.

Roth withdrawal rules are different. Early withdrawals of Roth IRA or Roth (k) contributions are not subject to a 10% penalty, since they were made on an. You can withdraw money from an IRA at any time, but you may have to pay taxes and additional penalties if you don't meet certain conditions. Getting a solid. Roth IRAs must meet two requirements for you to take a tax- and penalty-free “qualified” distribution: A five-year holding period must have passed before the. Although you can't deduct contributions on your federal taxes as with a traditional IRA, the advantage is that after you retire, your withdrawals will be tax-. An early withdrawal of a Roth conversion could also be subject to a 10% recapture penalty, if it has not met the required 5 year aging period in your Roth IRA. Roth withdrawals, including any investment earnings, are not taxed if you meet the minimum qualifications. These include a five-year holding period from the. Generally, you can withdraw contributed principal at any time without taxes or early withdrawal penalties, regardless of your age or how long the funds have. Dipping into a (k) or (b) before age 59 ½ usually results in a 10% penalty. For example, taking out $20, will cost you $ Lost opportunity for. You won't have to pay the early-distribution penalty 10% additional tax on your Roth IRA withdrawal if all of these apply. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. If you're at least age 59½ and your Roth IRA has been open for at least five years, you can withdraw money tax- and penalty-free. See Roth IRA withdrawal rules. Roth IRA withdrawal rules include the five-year rule for penalty-free withdrawals, and required minimum distributions for inherited IRAs. But if you're younger than that, you will get hit with a penalty for early withdrawals from traditional IRAs, or early withdrawals on earnings from Roth IRAs. Withdrawal age. In the case of both a traditional and Roth IRA, you can start withdrawing funds (or in official terms, "take distributions") after. Age 59 and under. You may withdraw any contributions you made to your Roth IRA tax- and penalty-free. However, if you withdraw any portion of the earnings you. If your Roth IRA Distribution is not a qualified distribution, any earnings that are withdrawn are taxable and may be subject to the 10% early distribution. Qualified withdrawals of Roth IRA contributions are always tax-and penalty-free. However, any earnings withdrawn early could be subject to both taxes and. Be aware that there could be tax and penalty implications. If you take money out of your CalSavers Roth IRA and you don't meet the criteria for a qualified. Consider a Roth IRA Withdrawal A Roth IRA early withdrawal often has fewer restrictions and penalties than a traditional IRA distribution if you need access.